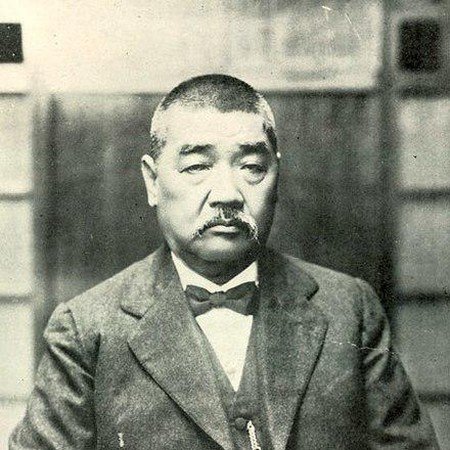

Mahkatop — The story of Kwik Djoen Eng, a prominent entrepreneur from Fujian, China, who operated extensively in Java during the 19th century, serves as a stark reminder of how business success can swiftly transform into financial ruin when reliant on excessive debt.

Alongside his brother, he established Kwik Hoo Tong Handelmaatschappij in 1894, specializing in trade commodities such as sugar, tea, rice, coconut oil, and charcoal.

Kwik was renowned for his adeptness in securing substantial loans from institutions like the Bank Sentral Hindia Belanda (de Javasche Bank) and other international banks, which facilitated his business expansions into China and Japan.

By the 1920s peak, Kwik Hoo Tong had risen to become one of the world’s top five companies, boasting profits amounting to 14 million guilders.

However, this prosperity was short-lived. Kwik found himself embroiled in a severe financial crisis as Kwik Hoo Tong’s revenues plummeted sharply in the mid-1920s.

With operations heavily financed through debt, Kwik and his company struggled to meet towering repayment obligations. Efforts to mitigate this with fresh loans only exacerbated their financial woes.

In January 1935, after four decades of building his commercial empire, Kwik Hoo Tong was formally declared bankrupt, its entire assets seized by de Javasche Bank, now recognized as Bank Indonesia. Kwik’s demise around the same time marked the tragic end of a journey for an entrepreneur once counted among the era’s wealthiest.

Kwik Djoen Eng’s life underscores the perilous pitfalls of constructing business empires upon unsustainable debt foundations. (*)